BUSINESS MODEL

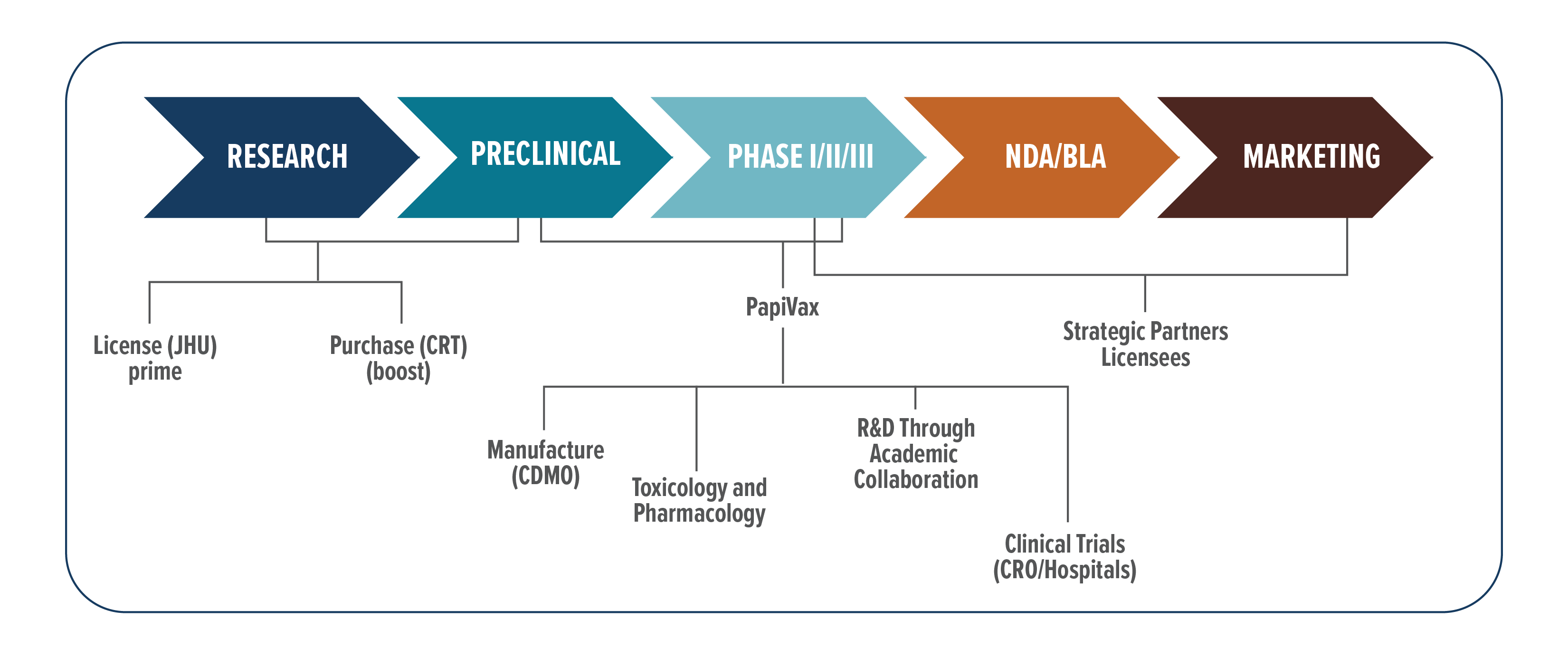

PBI’s business model is based on maximizing the impact and value of its core immunotherapy technologies through a combination of product development and platform licensing. This hybrid product / platform strategy ensures that PBI maintains direct control of the development pathway and timeline for its internal candidates while licensing the platforms for use in other disease indications to provide for alternative revenue streams and diversification of technical risk.

PBI’s has developed a portfolio of HPV product candidates (PVX4, PVX7, PVX8) capable of addressing unmet medical needs associated with therapy of HPV-related diseases, from early stage cervical lesions through late stage cancer. In addition to providing a compelling market opportunity, PBI prioritized HPV indications because there is a favorable pathway for clinical development and eventual product licensure. Specifically, the target antigens (HPV E6/E7) are drivers of the diseases, unique to the diseased tissue and non-self, making them ideal for induction of target immune responses. There are also FDA approved diagnostic tests broadly used in routine patient screening and follow up and there are clear clinical endpoints to assess product efficacy. Moreover, several of these disease indications are eligible for orphan product and breakthrough therapy designation which enables a favorable pathway to regulatory approval. PBI has reduced technical and development risks of its programs by leveraging clinical collaborations with leading academic research centers in the US (Johns Hopkins University, University of Alabama, Vanderbilt University, Washington University) to obtain initial clinical data on PBI products and thereby allowing only the most promising candidates to proceed into late stage clinical testing. Demonstration of positive clinical outcomes combined with securing breakthough therapy and/or orphan product designations will dramatically enhance the value of the PBI product candidates. In parallel with its clinical development efforts, PBI will be evaluating strategic partners to support product commercialization in U.S. and international markets. Based on the current HPV market potential development partners include large pharma / biotech developers with established presence / strategic interest in the HPV market (GSK, Merck, Bristol-Myers Squibb, Regeneron, Genentech, and AstraZeneca) as well as HPV diagnostics companies (Roche, Qiagen, and Hologic). PBI will evaluate a range of strategic options for partnering / outlicensing by indication and / or market jurisdiction.

In addition to developing its own HPV product franchise, the company is pursuing a platform licensing strategy to maximize the impact and value of its core adjuvant + device technologies. This involves entering into licensing, partnering, and/or co-development agreements with other commercial and academic research institutions that are pursuing applications of the PBI immunotherapy platform in broader indications outside of HPV. Such licensing agreements contribute to revenue generation for the company through upfront license / technology access payments, milestone achievements, and potentially ongoing royalties or revenue-sharing arrangements based on the success and commercialization of products developed by licensees. The company has ongoing licensed programs and associated clinical trials for use of the TriGrid Delivery System in cancer immunotherapy targeting both conserved tumor associated antigens as well as personalized neoantigen targets unique to a given patient.

PBI is confident that positive clinical outcomes for its HPV products will generate substantial interest in the combination of PBI’s adjuvant and delivery platforms, significantly enhancing the value of associated licensing agreements and facilitating regulatory approvals of partnered / licensed products in the pipeline.